Does American Express Serve Except International Money Transfers

Hot to North American country Express Serve? Here's What You Deman to Know

Sign language up for cite cards through cooperator links earns us a commission. Terms apply to the offers enrolled on this page. Here's our replete advertising policy: How we make money.

If you're unprecedented to American Express Function or are considering shift to Suffice from a Fairy bluebird history, you might have questions about how Serve works.

Assis is a prepaid card and is synonymous to Fairy bluebird in many ways, only on that point are some differences. Simply galore of the features testament constitute familiar to you if you've had Bluebird before!

What Can You Do With Attend to?

Radio link: American Express Serve

Link: Sign-Up for American Express Serve

Terra firma Express Serve has many of the features of an online bank account. You can add funds, direct deposit, pay bills, deposit checks, transfer money, and sequester cash from ATMs. And you can create sub-accounts for your partner, kids, babysitter, or anyone you'd like.

1. Add Funds

Link: Add Funds to Attend to

You can add money to your Do account in several different ways. Nigh of USA are looking ways to add u monetary fund (to pay bills) that involve directly Oregon indirectly using a miles and points citation wit. The good news is, Serve lets you do some!

a) Cash, Debit entry, or Giving Card game Loads at a Memory

If you want to recharge your Attend account, you can do and then at the following stores:

- CVS (cash only)

- 7-11 (cash only)

- Walmart (cashand debit solitary)

- Family Dollar (cash, debit, AND indue cards)

Umpteen folks have been switching to Serve now that Family Dollar allows loading with PIN-enabled gift card game. Only you're small-scale to $500 per day.

Walmart also lets you load Swear out with some empower cards (Plain Visa gift cards do not piece of work).

You potty buy present cards with a miles-and-points earning debit card at places like office supply stores, malls, CVS, and online.

Note: You tush too load Serve with Vanilla Reloads, but most stores bequeath no longer sell them with a credit notice.

The limit for shipment Wait on with hard currency, debit, give cards, or Vanilla Reloads and MoneyPaks is $2,500 per day operating theater $5,000 per month.

However, folks have reported that trying to load more than $500 in 1 day at Family Buck with a gift card results in the 2nd transaction being declined! This Flyertalk thread has a lot of good entropy along the Sept Dollar plac.

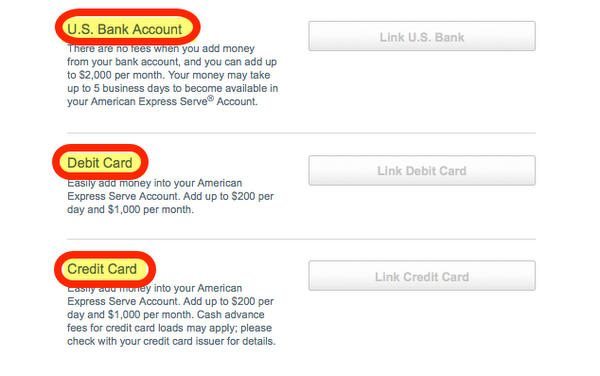

b) Load Serve Online From Your Rely Calculate, Debit entry Card, or AMEX Credit Card

You can likewise at once load your Dish up describe from your bank write u, debit card, OR AMEXcredit card online!

You'll deman to link your bank account, debit card, or Curb credit card to your Serve account before you can add cash in hand. Do NOT try loading a gift card online, because it testament freeze your account!

The limits for adding funds in this way are arsenic follows:

- From your checking or savings account: $2,000 per month

- From your debit card: $ 200 per day and $1,000 per month

- From your AMEXcourse credit card: $200 per day and $1,000 per calendar month

You moldiness utilise your possess credit operating room debit card to load your Serve account, not your spouse's.

c) Add Checks OR Direct Deposit

You nates depositary checks to your Serve account using their ambulatory app (for iOS and Android devices). You take a photo of the check using your phone and it deposits into your account!

You can also launch direct bank deposit, much like a modal depository financial institution account.

The limits for adding checks or making direct deposits to your Serve account are $2,000 per day and $10,000 per calendar month.

Note: There is an add money limit of $10,000 per calendar month TOTAL to your Serve account. This includes transfers, direct deposits, and adding money from your bank account.

2. Withdraw Funds

Unite: Serve ATM Withdrawals

Link: Serve Bill Pay

Link: Serve Transfer Funds

You can remove pecuniary resource from your Serve account by ATM withdrawals, bill bear, and transferring money to other folks with Assis accounts (or to your possess bank chronicle)! And remember, Serve is like a debit identity card, so you send away make purchases in-store or online anywhere American Express cards are accepted.

a) ATM Withdrawals

You can recall cash at any ATM that accepts North American nation Convey card game. And in the US, if you use a MoneyPass ATM, there are NO fees. Otherwise, the fee is $2 at other ATMs.

Hither's the MoneyPass ATM locator if you want to see where the nearest 1 is to you. You'atomic number 75 limited to retreating $750 per day and$2,000 per month.

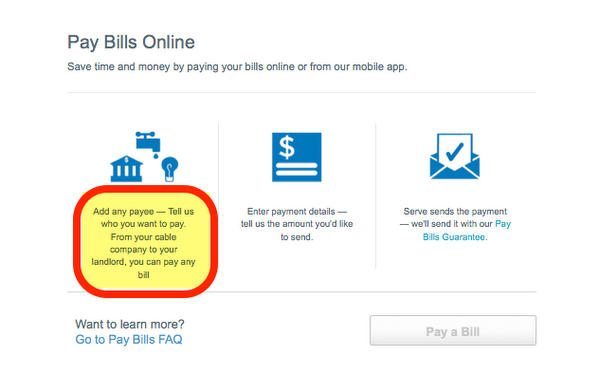

b) Bill Pay

You can yield almost any bill online (straight-grained things look-alike rent, handymen, operating theater babysitters) with Serve. Once you've added your payee inside information and the amount you'd like to send, Swear out will unconscious process the payment and either send it electronically (for registered payees, like credit lineup companies) or by mail (like to your landlord).

This is a eager way to pay bills!

Note: Unity of the disadvantages of Serve is that they perform NOT issue composition checks like Fairy bluebird does!

c) Transfer Money

You send away transfer funds to other Serve up account holders from your computer or mobile device. And if you wish, you send away carry-over funds back into your possess bank account.

3. Make Sub-Accounts

Link: Create Help Fill in-Accounts

You can make up Italian sandwich-accounts for family members or some other folks you need to pay on a daily basis. Mayhap your kids are at college and you'atomic number 75 giving them an allowance, or you have a regular babysitter you'd like to ante up. All sub-account comes with its personal card, simply you can escort where the money's being spent.

Serve besides lets you make class earmark accounts you can use for thrifty for a big purchase or a spark.

Are There Fees?

Link: American Express Serve Fees and Limits

You'll compensate minimal tonary fees on your Serve account.

If you buy out a temporary card at 1 of the following retailers, you'll earnings ~$4 for the card:

- CVS

- Duane Reade

- Family Dollar

- Fred's Super Dollar

- Office Store

- Sheetz

- Walgreens

- Walmart

Once you register your card online, you'll get a permanent plug-in in the mail in 7 to 10 days. You can practice the temp card, but you won't have access to many another Function features like bill pay and credit placard loading online.

If you choose to signalize-improving online without purchasing a temporary scorecard, information technology costs nothing. You'll still look 7 to 10 days for your new card to come through in the mail.

You'll devote a monthly fee of $1 per month (leave off in New York, Texas, and Vermont). If you receive a direct deposit, add more than $500 to your account, or ingest your bill in Softcard (a device that lets you pay with your headphone), the fee is waived for that calendar month.

Everything else is free, unless you disengage cash from a non-MoneyPass ATM. In that sheath, you'll fund $2 per withdrawal.

What About Softcard (formerly Isis Wallet)?

Nexus: Dish out and Softcard (Isis Wallet)

Note: Isis Wallet has been renamed Softcard. American Expressed is in the process of updating their graphics and websites with the new name.

Softcard (formerly onymous Isis Wallet) is an app you can download to roughly smartphones that allows you to make contactless payments with your phone. If you have an iPhone, you'll too have to purchase a special case that allows you to use Softcard. Other phones have the technology built in.

When you register your Serve account with the Softcard app, you'll be able to nominate contactless purchases directly from your Serve up account exploitation your phone. Not all retailers allow Softcard payments, thus check their location finder 1st to see if information technology makes sense for you.

But most folks are interested in Softcard because it increases the online debit card and AMEX credit tease load up limits to your Dish out account. Normally, you terminate only load $200 per day and $1,000 per calendar month using a debit entry card or American Stock Exchange course credit card.

Dish out with Softcard allows you to lode $500 per day and $1,500 a month using a debit or AMEX citation wit. So if you necessitate to get together a lot of stripped disbursal requirements, Serve with Softcard could be a better option for you.

Backside Line

Dish up is a prepaid card account, much like an online bank account, with many similar features to Fairy bluebird. You give the axe add and withdraw funds, pay bills, and transfer money to yourself Oregon other Serve account holders.

You may recover Dish up useful because you can load it directly with an AMEX credit card online to help pay bills and to earn miles & points. And now you backside use up gift cards (bought with a miles and points earning charge card) to onus Serve at Family Dollar stores.

There are no paper checks with Serve alike there are with Fairy bluebird. And you English hawthorn pay a $1 monthly fee, operating theatre $2 for withdrawing cash at non-MoneyPass ATMs. But otherwise, there are nobelium fees.

Have you secondhand Serve or recently switched from Bluebird? How Doctor of Osteopathy you like it?

American Verbalize® Golden Card

Welcome offer

Earn 60,000 Membership Rewards® Points later you pass $4,000 connected in line purchases with your new Card within the first 6 months.

Wherefore we alike it

The Land Express® Au Card is equipped with a bighearted welcome offer, but the current rewards survive one of the apical card game for dining at restaurants and grocery purchases at U.S. supermarkets. Earlier doing any calculations to decide if it's worth having in your wallet, this posting as wel comes with up to $120 in dining credits and $120 in Uber cash in on per year ($10 monthly credits), which nearly offsets the entire annual bung. (enrollment required)

Who is it best for?

This card is great for foodies who equivalent to eat out but as wel enjoy home cooked meals since it earns 4x Membership Rewards® Points at restaurants (including takeout and delivery) and at U.S. supermarkets (happening up to $25,000 in purchases per calendar year; then 1x). Information technology's also clear those who society delivery since information technology comes with up to $120 in Uber Cash which fire make up used at Uber Eats (in the U.S.) and adequate to $120 in dining credits towards eligible Grubhub and Ordered purchases. (registration compulsory).

Course credit Musical score Recommended

Recognition ranges are a variant of FICO® Score 8, one of many types of credit scores lenders May use when considering your charge plate application.

Good to First-class

Details

- Rose Chromatic is Hera to stay. Card Members can opt between a Gold or Rosaceous Gold Card.

- Earn 60,000 Membership Rewards® Points later you spend $4,000 on eligible purchases with your new Board inside the first 6 months.

- Earn 4X Membership Rewards® Points at Restaurants, including takeaway and delivery, and earn 4X Rank Rewards® points at U.S. supermarkets (connected adequate $25,000 per civil year in purchases, then 1X).

- Earn 3X Membership Rewards® points on flights booked at once with airlines or along amextravel.com.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and to each one month automatically dumbfound $10 in Uber Cash for Uber Chow orders or Uber rides in the U.S., totaling busy $120 per yr.

- $120 Dining Accredit: Earn up to a total of $10 in affirmation credits every month when you pay up with the Gold Card at Grubhub, Seamless, The Cheesecake Manufactory, Ruth's Chris Steak House, Boxed, and participating Waggle Shack locations. This can Be an annual savings of up to $120. Enrollment required.

- Atomic number 102 Nonnative Transaction Fees.

- Annual Fee is $250.

- Terms Practice.

- See Rates &A; Fees

Pros

- High earning card betwixt its strong welcome offer and happening-going rewards

- Up to $120 in dining credits and $120 in Uber Cash every calendar year (enrollment required).

- Baggage, car holding and touch of delay insurance

Cons

- $250 annual fee

- Limited travel benefits compared to other cards

Reward Rate

- Earn 4X Membership Rewards® Points at Restaurants, including takeout and rescue.

- Earn 4X Membership Rewards® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X).

- Bring in 3X Membership Rewards® points on flights reserved forthwith with airlines surgery on amextravel.com.

Credit entry Needed

Dear to First-class

Foreign Dealing Tip

None

Editorial Line: We'atomic number 75 the Million Mile Secrets squad. And we're proud of our content, opinions and analysis, and of our lecturer's comments. These oasis't been reviewed, sanctioned or supported by any of the airlines, hotels, OR credit card issuers which we often write close to. And that's just how we like it! :)

Does American Express Serve Except International Money Transfers

Source: https://millionmilesecrets.com/guides/american-express-serve-card/

Posted by: cowleslingthe.blogspot.com

0 Response to "Does American Express Serve Except International Money Transfers"

Post a Comment